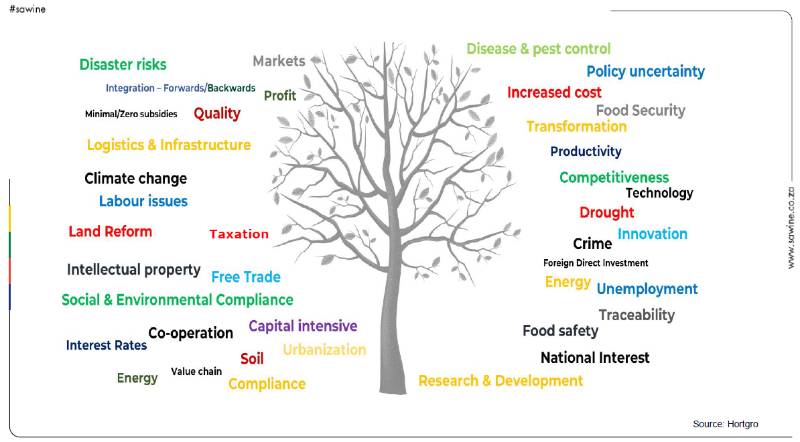

It's no secret that uncertainty has become the new normal for the global wine trade. And while South Africa isn't alone in facing economic headwinds, the nation's wine industry - ranked 8th in terms of litres produced annually - has a unique set of hurdles to clear, from land reform to climate unpredictability.

At a recent summit hosted by South Africa Wine in Stellenbosch, CEO Rico Basson laid out eight "must-win battles" for the industry's survival. These aren't merely goals - they're lifelines:

1. Protecting the industry's licence to trade (illicit trade2, health, excise) and grow domestic value

2. Promoting inclusive growth across the value chain

3. Supporting export enablement (logistics, market access3, differentiation, premiumisation)

4. Embracing sustainable practices including climate adaptation strategy

5. Improving producer profitability & reinvestment

6. Upping industry education and training (attract, develop & retain)

7. Ensuring access to resources (water, finance, packaging)

8. Building access to and ownership of data

It's a formidable list - an elephantine task, to borrow a proudly African metaphor. Yet with the industry's proven track record of resilience - showcased during Covid-19 lockdowns when the South African government shutdown exports and banned the transport and sale of alcohol – there's a quiet confidence that they will be won, even if slowly.

Moreover, the industry has a number of assegais in its arsenal. Indeed, it is one of very few wine-producing countries to be in an equilibrium stock position, versus many others, exporting its stock holdings built up during the alcohol bans by the end of 2023.

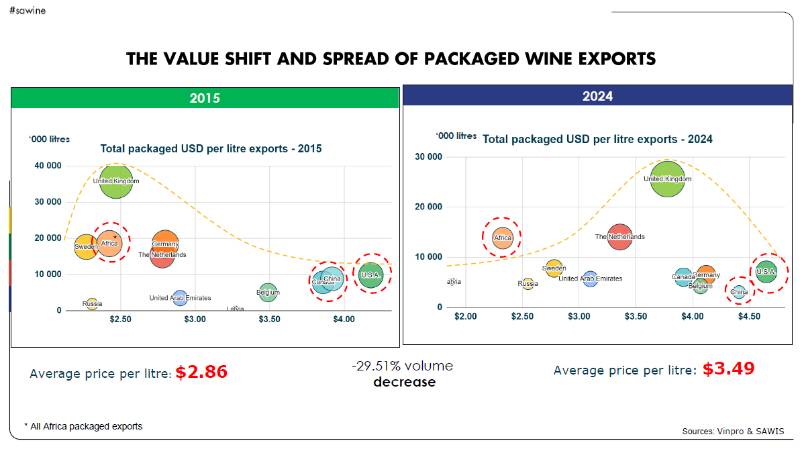

Even more encouraging is the shift in export dynamics. In just a decade, South Africa has transitioned from high volume/low price exports to high volume - and high value - wine sales. Nowhere is this more evident than in the UK, the country's biggest global market. Meanwhile, producers have maintained a small but high value market in the US. But it's not just an opportunity - it's a growth engine. With global tourism projected to grow by more than 12% a year, potentially exceeding $350 billion by 2035, this is low-hanging fruit for the industry.

So, too, could be growing its domestic market, particularly in Gauteng, the country's economic powerhouse and most populated province. Currently, Gauteng consumes more wine by volume than South African wine's biggest export market.

But let's not kid ourselves: this is a beer-drinking nation. One brand alone - Carling Black label - has the same retail sales value as all 9,000 of the country's wine labels combined. That's a sobering reality.

Yet there is cause for optimism as South Africa is a young nation with a significant population under 30. The median population age in France and Italy, for example, is 42 and 46 respectively. And while the jury is still out - the industry awaits the findings of a new report into the frame of mind of South Africa's youth - many are optimistic that Gen Z South Africans see and value wine differently to their European and US counterparts.

The path ahead will be steep. But the view from the top? Worth it.

South Africa's bold growth vision

As global uncertainty reshapes the wine industry, South Africa finds itself at a crossroads. Yet industry stakeholders have a bold vision, rooted in sustainability, for growth and development.

South Africa looks to a bright future

.png)