Long associated with Port, the Douro is increasingly a multifaceted player in the world of premium red and white wines. As global demand for fortified has weakened in the 21st century, wineries have been forced to broaden their horizons – Quinta do Vallado, for example, now dedicates 80% of its production to still wine. The result has been not a bidding war between tradition and modernity, but a pragmatic re-balancing: stakeholders regard this evolution as a commercial necessity that will help preserve the valley's communities, vineyards, and livelihoods. The only question is: are consumers on board?

"There are still a few people who think Douro wines harm Port, but that view is fading. I believe in synergies. The Douro is vast - 45,000 hectares - and contains many identities. Some vineyards are clearly perfect for Port, but many are actually better suited for still wines," says Dirk Niepoort, fifth-generation leader of this venerable house.

"The wines have attracted new audiences, people who want to visit the Douro, experience this dramatic, majestic landscape, and then discover Port as well. And vice versa. What matters most now is giving the region stability."

Commercial reality

This pivot follows hard market signals, rather than simply an attempt to broaden the palate for creativity's sake. Multiple industry reports point to a significant decline in the demand for fortified wine, due to evolving lifestyles, economic headwinds, and the growing moderation trend; however, ViniPortugal also reported that Portuguese wine exports hit €928 million in 2023, while international tourism to the Douro is booming. Meanwhile, insiders claim that table wines now account for roughly half of the region's grape harvest, while industry bodies have been pushing for regulatory reform, largely because the old system favours Port quotas and fixed yields. A structural realignment is underway.

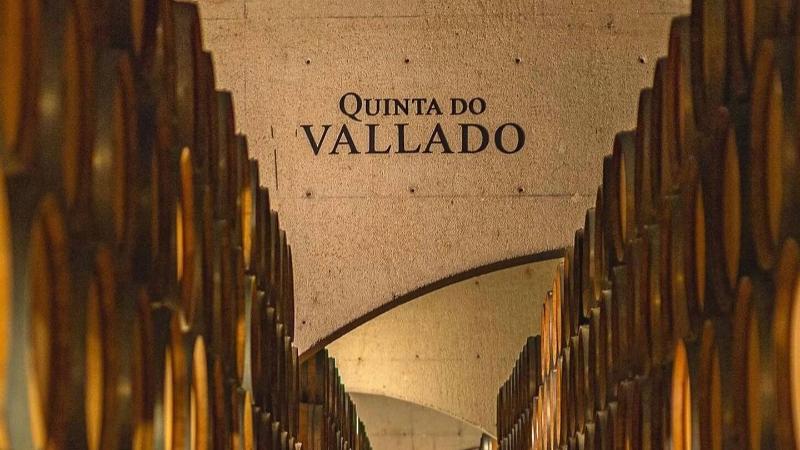

"For nearly two centuries, our focus was exclusively on producing Port that was sold through the Ferreira Port House. However, since the early 1990s, we have embraced the production of still red, white, and rosé wines under our own label," explains João Ferreira Álvares Ribeiro, owner of Quinta do Vallado.

He continues: "Our strategy is not to let one overshadow the other, but to present a complete portfolio that showcases the versatility and potential of the Douro. Our still wines are not an afterthought; they are a primary focus. This shift was a deliberate decision to explore the unique terroir of our vineyards for unfortified wines. We built a state-of-the-art winery in 2009, designed for gravity-flow winemaking, to produce the highest quality still wines."

According to Álvares Ribeiro, this shift is having a profound impact on local viticulture. Indeed, everything from harvesting schedules - picking earlier for freshness in white and rosé wines - to how producers utilise their land has been affected. "We use our higher-altitude vineyards in the Douro Superior to cultivate grapes with higher acidity, perfect for producing lighter, more elegant still wines," he says.

"Where our vineyards were once dominated by the traditional field blends of Port, we began a significant restructuring in the 1990s to plant single-varietal plots. This move allows us to achieve optimal ripeness for each grape variety, giving us the precision needed to craft high-quality still wines." Niepoort and the so-called "Douro Boys" catalysed this change in the 1990s and early 2000s, proving that the same terroir behind great Ports could be adapted to other uses.

The Douro has also attracted some A-list investors from further afield, most notably Bruno Prats, Michel Chapoutier, Vincent Bouchard, and the Cazes family – owners of Lynch Bages. They have brought additional capital, technical know-how, and marketing panache to the Douro – all essential ingredients in the effort to promote the Douro as a leading source of exceptional red and white wine.

"The growth in the production of still wines in the Douro is very positive for the region, firstly because it has contributed to increasing its visibility throughout the world, and also because it positions the Douro as a region with a wider range of products," notes Carlos Alves, director of viticulture and winemaking at Sogevinus.

He adds: "The Douro is no longer seen only as the origin of Port wine, but as a versatile wine region, capable of producing wines with very diverse characteristics that adapt to different consumer profiles and consumption moments."

The long road ahead

Of course, the task of turning potential into sales ultimately rests with the trade. According to leading importers, Douro wines often require a patient hand-sell in a market where the region's mnemonic is fortified sweetness. Moreover, "Douro wines often sit at a higher price point compared to other regions in Portugal and haven't quite made it to the same status as some fine wine regions like Bordeaux or Rioja," as Steve Daniel, head of buying at Hallgarten & Novum Wines, underlines.

However, he adds that "there is plenty in terms of storytelling that we in the trade can leverage, such as the unique sloped terroir, and embracing native grape varieties". Distributors and sommeliers are therefore leaning on three tools: storytelling, strategic placement (independent off-trade and hospitality listings rather than being shoe-horned in as a 'value Portugal' addition), and careful price positioning to reflect the often high production costs of Douro table wines.

But cost, unfortunately, remains a consumer sticking point. "Portugal has gained a reputation as a value-driven region overall – so pushing the premium pricing angle of Douro wines is always going to be trickier," admits Daniel.

"Douro wines are pricier as they are by and large all hand-harvested (owing to the steepness of the vineyards), but they are gaining popularity. For pricier Douro wines to enter the mainstream consumer mindset can take time but the progression is taking place, even if it is slow."

There is no doubt that significant structural hurdles have yet to be overcome: consumer awareness is uneven, the multiples still paint the country as a source of affordable wines, and regulatory structures in the Douro require a vast overhaul. Meanwhile, global declines in wine consumption mean every producer must fight for share of a smaller pie.

Yet other indicators are more positive. Consumers are attracted to stories, as Daniel observes, while there is an appetite for learning about indigenous grape varieties and wines with a sense of place; rising tourism-led discovery also signals important momentum. If the Douro is to sustain its landscape and communities, ongoing investment in still wine production – and a coordinated push by gatekeepers in the trade – will be essential. The Douro has shown itself adaptable before, reshaping tradition without abandoning it. What remains to be seen is whether its next chapter will prove as enduring – and as defining - as its fortified past.

The Douro's Vital Pivot

Once synonymous with Port, the Douro is redefining and expanding its offer in a mercurial age.

The Douro is undergoing a rebirth

.png)